The first step for students that are looking for help in paying for college is filling out the Free Application for Federal Student Aid (FAFSA) form. Filling out this form feels like a daunting task for many students, but it can be straightforward and faster if you are prepared. In this post, you will find some tips that can help you get the most financial aid.

Things that you need before you fill out the FAFSA form

1. Financial Student Aid account (FSA ID)

FSA ID is the username and password that you need to access U.S. Department of Education website. Both students and their parents need this ID to complete the FAFSA process. You should create your FSA ID early, even before you are ready to start filling the FAFSA form. Doing so will help you avoid delays that can make you miss some student financial aid. Watch step-by-step guide on how to create your FSA ID.

Students that are required to submit their parent’s information should ask them to create their FSA ID too. It isn’t right to apply for an FSA ID for another person. It is not okay for parents to create FSA IDs for their children. Students should also not create FSA ID for their parents. You also need to use your personal email and phone number when creating your FSA ID. If you create an FSA ID for another person, you will experience issues when signing and submitting the FAFSA form. To avoid FAFSA delays that can make you miss financial aid, you should create your FSA ID now.

2. Social Security Number (SSN)

Social Security Number is the number on the Social Security card. If you don’t have access to this card, you should get a replacement from the Social Security Administration. Non-US citizens that meet the eligibility requirement for Federal Student Aid should use their Alien Registration Number.

3. Driver’s License Number

Not everyone has a Driver’s License. If you have it, you will need that number when filling out the FAFSA form. If you don’t have one, you can be able to apply and fill out FAFSA.

4. Tax records

There have been some changes in the FAFSA process. Students and parents now have to report their income information every year. Before you start filling out the FAFSA form, you should have your previous year’s tax return records for reference.

You should also have records of your untaxed income. You may or may not find questions about untaxed income when filling out the FAFSA form, but having the documentation with you is a great idea. Find out the specific details about untaxed income that you need.

5. Records of your assets

Assets include your accounts balance, stock, real estate, and other value of investments, apart from the home where your family is living. One of the common FAFSA mistakes is misinterpreting what is considered parent investment and student invest and what is not.

6. List of schools that you are interested in or planning to attend

You should add one school to receive your FAFSA information, but you can list up to ten schools. You will be able to remove and add other schools to your FAFSA form later. Listing more schools on FAFSA will help avoid missing student aid due to delays.

All the schools that you list will receive your FAFSA form electronically. They then use the information in this form to decide the type and amount of student financial aid that you can receive. There is no problem if you list a school in your FAFSA form and end up not applying. Remember, the school can not offer you any student aid until you are accepted.

For you to qualify for state student financial aid, some states require you to list these schools in a particular order. Remember, you can get federal student aid no matter the listing order that you use. Find out your state’s guidance for listing schools on the FAFSA form.

Tips for filling out FAFSA

There are several ways to fill out your FAFSA form. You can use the myStudentAid mobile app or the fafsa.gov website. If you are using your smartphone, using the myStudentAid app is the best option. The app is safe and secure. You can also use the app to view your loan and student aid information, manage your FSA ID, and many more. Here are some tips for applying for filling out FAFSA that can help you avoid making a mistake:

1. Apply online

Online FAFSA application is faster than the paper version. It will be easier for you and your parents to fill out and the recipients to read and review. All that you need is to make sure that you are using your valid email address. A link to your student aid report will be sent to you via your email within 3 to 5 working days. For the paper application, you will have to wait for the link for 2 to 3 weeks.

2. Don’t skip steps

You should fill every field in the FAFSA form. If something does not apply for you or you don’t have information about it, you should write “not applicable” or enter “0”. If you leave blank spaces, your FAFSA application is more likely to be rejected. If accepted with blank spaces or empty fields, that might result in incorrect calculations. To avoid all that, you should fill every space of these forms.

3. Round properly

When you are using a numeric number on FAFSA, you should round it to the nearest dollar. You also don’t have to worry about using commas in numerals. Avoiding the use of decimals and commas in your numerals can help prevent number errors, especially when you’re filling an online application.

4. Provide the right information

Many students make mistakes when filling in marital data. They don’t list their marital status as per the day they are filling out the FAFSA form. For example, if your parents had a divorce and your custodial parent has remarried, you should include your step-parent on your FAFSA. If your parents are living together, you should add both of them to your FAFSA no matter whether they are still married or not.

5. Watch the deadlines

You should fill out your FAFSA as early as possible. Apart from the deadlines, the earlier you submit your FAFSA, the higher your chances of getting financial aid. Remember, many student financial aids use the first-come-first-served formula when awarding offers. If you submit your form later, you are more likely to find some aids already exhausted by the time they review your information. You might qualify for a given aid but miss it if you fail to submit your FAFSA as early as possible. You should also submit your FAFSA every year, no matter whether your financial situation has changed or not. If you fail to submit your FAFSA completely, you should not expect to get any student financial aid for that specific year.

What to do after filing your FAFSA form

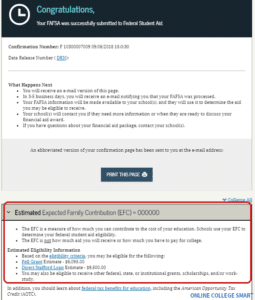

1. Review your FAFSA confirmation page

After filling out your FAFSA and hitting the Submit button, you will see a page like the one below.

It is not a financial aid offer. It provides you with an estimation of the federal aid that you can get based on the information you have submitted. To calculate the actual amount of student financial aid that you are eligible for, schools will take into account other factors like the cost of attending school. You also need to note that these estimates are for federal aid only.

2. Apply for as many scholarships as possible

Many schools can’t meet your financial needs. It is upon you to pay the gap between school costs and the financial aid that your school offers. Scholarships can help fill this gap. They are free money that you won’t have to pay back after graduating. Don’t wait until you know how much student aid you are going to offer for you to start applying for scholarships. There are so many scholarships, and most of them have deadlines. Applying for these scholarships will take your time, but their possible pay is worth it. Remember, it is free money, and you can’t get it if you fail to apply. You should take advantage of the scholarships available for you to reduce your school cost.

3. Look out for your aid offers

After submitting your FAFSA form, you will have to wait for some months to get your aid offers. It is schools that disburse student aid and not the FAFSA guys. Every school has its schedule for awarding and paying out these aids. You should contact the school’s financial aid office for more information about the specific dates they will disburse student aid offers.